Optional cookies and other technologies

See full list on corporatefinanceinstitute.com. An expense is the cost of operations that a company incurs to generate revenue. As the popular saying goes, “it costs money to make money.” Common expenses include payments to suppliers, employee. Find 7 ways to say EXPENSES, along with antonyms, related words, and example sentences at Thesaurus.com, the world's most trusted free thesaurus. Expenses in the fourth category are not deductible, except in a few cases (medical expenses, charitable contributions, etc.) in which they are specifically allowed by law. Expenses are to be distinguished from 'capital expenditures,' defined elsewhere in this glossary. What are Accounts Expenses? An expense in accounting is the money spent, or costs incurred, by a business in their effort to generate revenues. Essentially, accounts expenses represent the cost of doing business; they are the sum of all the activities that hopefully generate a profit.

We use analytics cookies to ensure you get the best experience on our website. You can decline analytics cookies and navigate our website, however cookies must be consented to and enabled prior to using the FreshBooks platform. To learn about how we use your data, please Read our Privacy Policy. Necessary cookies will remain enabled to provide core functionality such as security, network management, and accessibility. You may disable these by changing your browser settings, but this may affect how the website functions.

Mac not good for gaming. To learn more about how we use your data, please read our Privacy Statement.

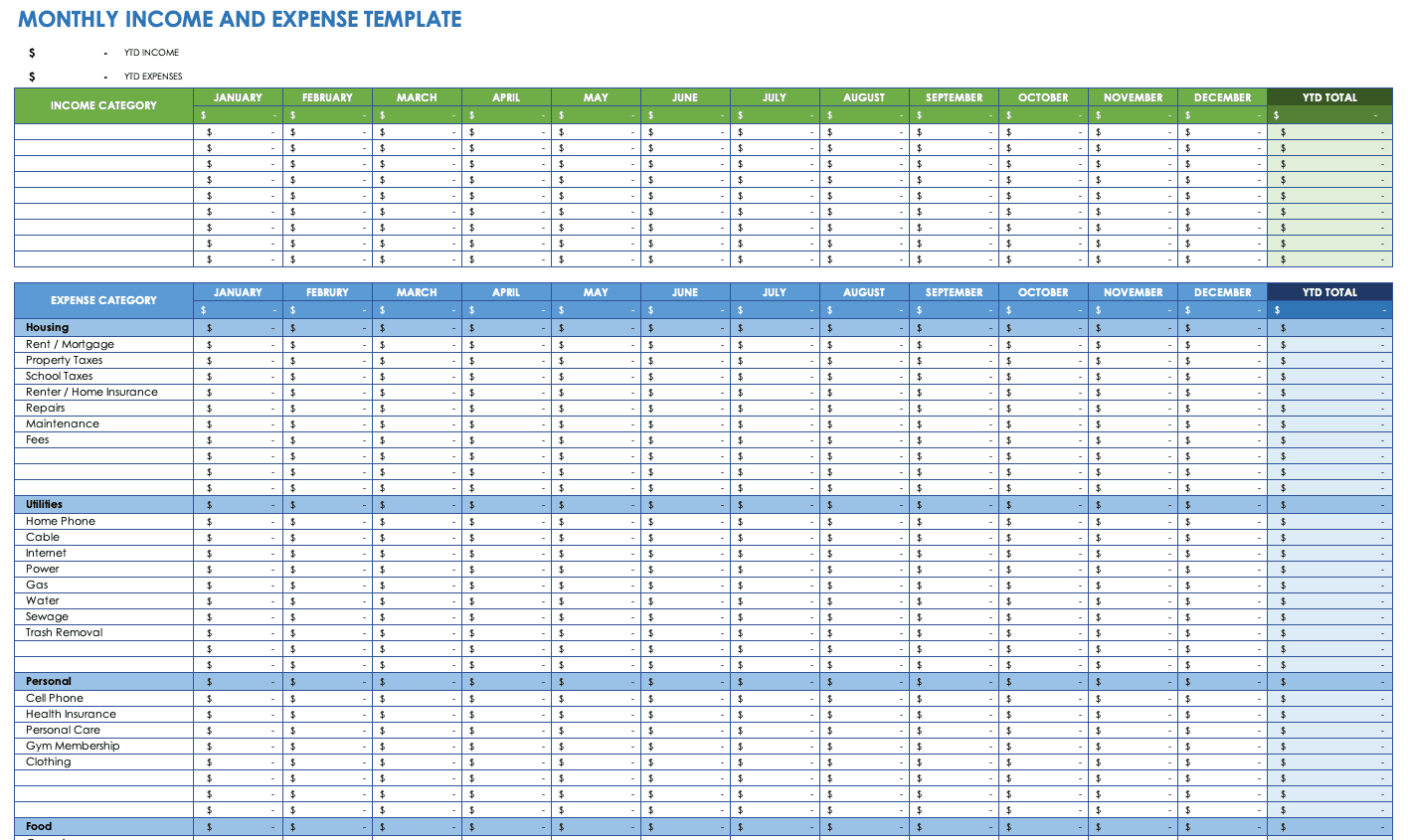

The next step in setting up a budget is to list your monthly expenses. There are three major types of expenses we all pay: fixed, variable, and periodic. Do you know the difference?

When I first started budgeting, I set up an excel spreadsheet for the year. It was a daunting task to think about what my expenses would be for the next twelve months. The holiday season had just ended and the next one seemed forever away. How did I know how much money I was going to need in September when January had barely started?

Expenses Incurred

For years I had been living paycheck to paycheck just hoping my money would last until the next check came in. When bills came due I never really knew if I had the money to pay them. I had a very general idea of what my expenses were but inevitably I would spend way more than I thought I would. The idea of planning for my expenses, at least beyond my rent payment, was far outside my comfort zone. What finally helped me overcome my budgeting struggle was when I gained an understanding of the three types of expenses: fixed, periodic and variable.

First Type of Expenses: Fixed Expenses

Fixed expenses are payments we have very little control over as they represent a legal obligation to pay, such as your rent or mortgage. You might also have a car loan or other type of secured loan. These expenses occur at predictable intervals, typically monthly. I like fixed expenses because they are easy to predict and while covering them can be a financial challenge, they are never a surprise and are easy entries in my budget spreadsheet.

Second Type of Expenses: Periodic Expenses

Periodic expenses are a little more challenging to budget for. Similar to fixed expenses, we have little control over periodic expenses but where fixed expenses typically recur on the same date every month, periodic ones are what I call “expected surprise” expenses. It sounds like an oxy-moron to have an “expected surprise” but I am sure you have all been there. These are the bills that we have to pay that come in quarterly or semi-annually that we totally forget about. For example, my trash gets picked up every Thursday morning but it isn’t until the quarterly statement arrives in the mail that I remember we have to pay for trash pick-up. The bill amount has not changed in three years but I still sometimes forget to put it in my budget. The best way to ensure there is money in your bank account for these types of expenses is to plan a portion of them into each month of your budget.

Third Type of Expenses: Variable Expenses

The third type of expense is Variable expenses. These are also known as discretionary expenses. While they can be challenging to budget for, this is my favorite category because this is where we have all the control. These are the expenses that we can influence with our behaviors. Variable expenses are the money you spend on food, clothing, and entertainment. The challenge to budgeting these expenses is that they are rarely exactly the same every month and they do not typically occur on the same day of each month. Budgeting for Variable expenses requires gaining a good understanding of where your money goes after you have paid your fixed and periodic expenses. The best way to find the answer to this is to track your expenses for a few months. We learn a lot about our spending habits and variable expenses when we track our activity for just a few weeks.

Expenses Calculator

Create a Budget

Creating a budget is the best way to not feel blindsided by money leaving your bank account. Understanding your fixed, periodic and variable expenses is the first step to making an effective budget. In future posts, we will explore how to control and even reduce each category of these expenses. To learn more about budgeting you can contact CCCSMD at 1 (800) 642-2227.

A “fixed expense” is a cost that does not change from time period to time period, or changes only very slightly. Which of these is a fixed expense?

- Your grocery bill

- Home repairs

- Your mortgage or rent

The correct answer is “C.” Car payments, real estate taxes, and life insurance premiums are also fixed expenses.